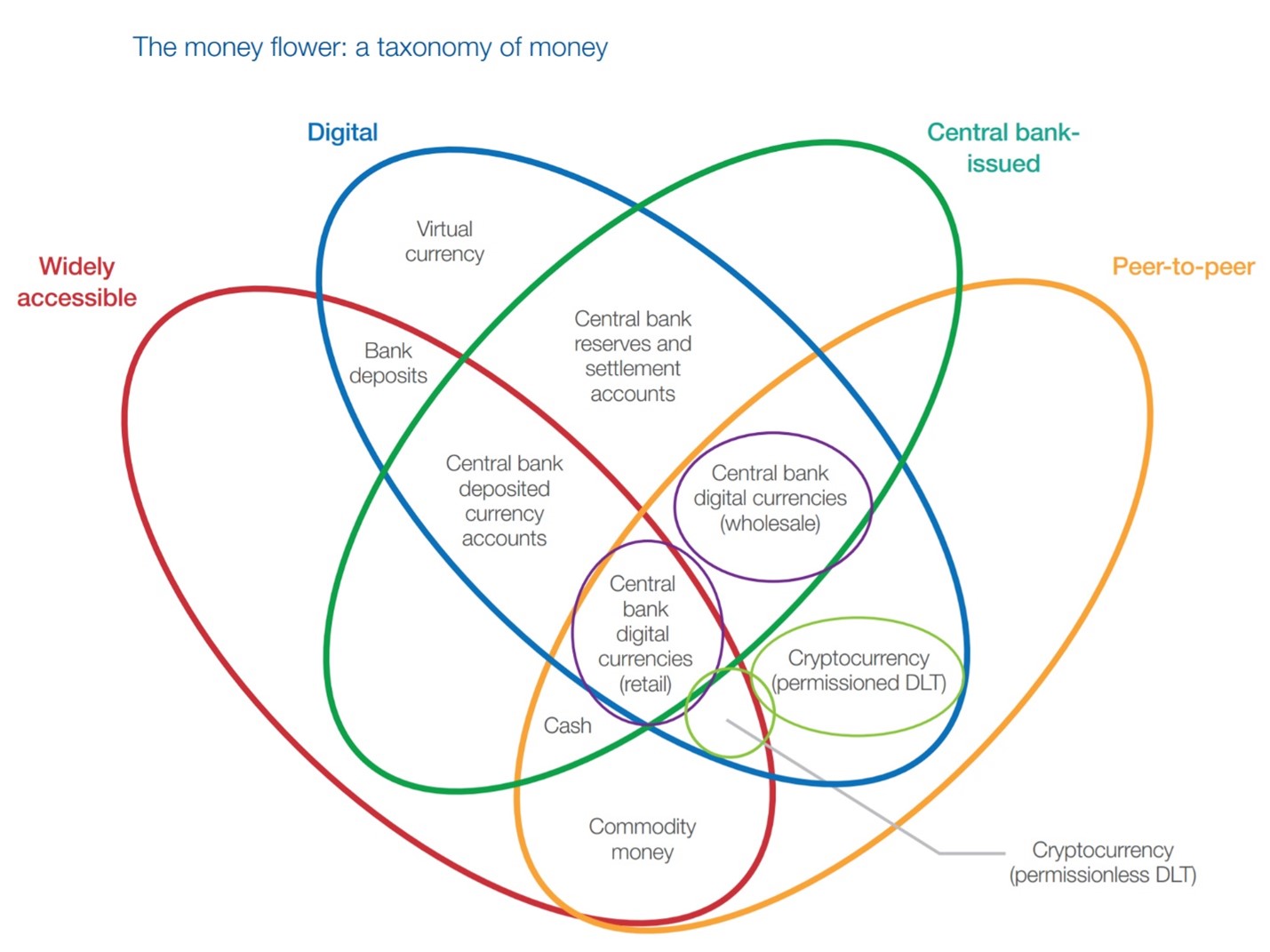

CBDC is a potential application of blockchain and distributed ledger technology

Digital Currency for Central Banks

We provide solutions for Central banks for researching and testing or private and permissioned blockchain that will fit their goals. A typical tiered-enterprise architecture with blockchain at its core is perfectly fine of handling the load and throughput of such payments system. Adding a blockchain or another distributed ledger technology as a base component, the issuing bank can have all the benefits of token based accounts like enhanced privacy, faster back-end reconciliation with fewer errors, funds predictability, end-to-end KYC and AML enriched transactions with cheaper fees, all within a legally robust framework.

What Are the Benefits of CBDC?

Central bank financial infrastructure currently faces a number of challenges, from costly payment settlement to the decreasing use of bank notes and lack of financial access for citizens far from bank branches. Studies have estimated that the cost of clearing and settling securities for central banks in G7 countries is over $50 billion per year, due in large part to the resources required to transfer assets and reconcile accounts. Moreover, today’s cross-border payment systems involve the transfer of assets and sensitive transaction data through several different correspondent banks, exposing institutions and individuals to settlement and operational risk.

Blockchain-based CBDC solves for the inefficiencies and vulnerabilities in our current central banking infrastructure by simplifying the creation of a secure payments system that serves as a large-scale, decentralized clearing house and asset register.

Benefits of Retail CBDC

I- ncrease availability. Digital currency can be distributed on mobile devices, increasing access and usability for citizens who are far from bank branches and cannot access physical cash.

- Streamline reconciliation. A CBDC is natively digital and does not require the costly and time-consuming reconciliation currently needs for e-commerce and cross-border payments.

- Foster digital innovation. CBDC’s platform-based software model lowers barriers to entry for new firms in the payments sector, fostering competition and innovation and pushing financial institutions toward the globalization of services.

- Enhance monetary policy. CBDC gives central banks direct influence over the money supply, simplifying the distribution of government benefits to individuals and improving control over transactions for tax controls.

Benefits of Wholesale CBDC

- Improve interbank payment settlement. Through automation and decentralized netting solutions, CBDC payments are settled instantly between counterparties on an individual order basis, reducing the risk of overnight batch processing and collateralization.

- Reduced counterparty risk. CBDC mitigates credit risk in cross-border payment transactions by enabling payment-versus-payment settlement for transfers in different currencies.

- Participate in digital asset markets. As more tokenized asset markets emerge, there will be a need for tokenized payments. CBDC provides a large-scale, decentralized clearing house and asset register to help foster the digital assets revolution.

- Stay competitive. Even though the cost of real-time money transfers has been reduced by centralized platforms like SEPA in Europe, most financial institutions charge customers above cost. CBDC allows end users to benefit from streamlined banking infrastructure and ensures central banks maintain a role in interbank settlement amidst the wider adoption of stablecoin technology.

For more information about our solutions, please contact us: contact@smart-digital.solutions